Introduction:

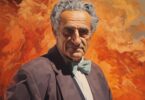

Michiel Le Roux, the billionaire banking magnate, transformed the South African banking landscape with his forward-thinking and innovative strategies.

Early Life:

Born in 1949 in South Africa, Michiel Le Roux’s modest upbringing taught him the values of hard work and determination. His early years, filled with challenges and perseverance, played a crucial role in shaping his future business acumen.

Rising Through the Ranks:

After a career in law and venturing into various businesses, Le Roux’s game-changer came in 2001 when he founded Capitec Bank. His vision was clear – a simplified, affordable, and accessible banking system for all South Africans. The bank’s disruptive approach to fees and its focus on the underserved saw it skyrocket in popularity and success.

Major Achievements:

- Founder of Capitec Bank, one of the most influential banks in South Africa.

- Revolutionized the banking industry with a client-centric approach.

- Recognized for pioneering innovations in mobile banking and simplified banking services.

- Became a key player in financial inclusion in South Africa.

Controversies/Challenges:

Like any trailblazer, Le Roux faced resistance. Traditional banking institutions were skeptical, and many predicted the fall of Capitec. Moreover, the global economic crisis posed challenges. However, under Le Roux’s leadership, Capitec weathered the storms, consistently proving naysayers wrong and building trust among its customers.

Legacy/Current Status:

Today, Capitec is a powerhouse in the banking industry, not just in South Africa but recognized globally. While Le Roux stepped down from active management, his ethos and influence remain intact. His legacy? A testament to what’s achievable when innovation meets purpose.

Quick Facts:

- Net Worth: $1.2 billion (as of 2022).

- Key Companies: Capitec Bank.

- Notable Quote: “Banking should be as simple as possible. Complexity is the enemy of progress.”

- Did You Know?: Under Le Roux’s guidance, Capitec Bank was among the first to introduce a single, transparent fee structure, reshaping South African banking norms.

Conclusion:

Michiel Le Roux’s journey, from his early challenges to the pinnacle of banking success, is a testament to the power of vision and resilience. His story prompts us to ask: In what other sectors and regions might such transformative changes be waiting just around the corner?